Turning challenges into opportunities

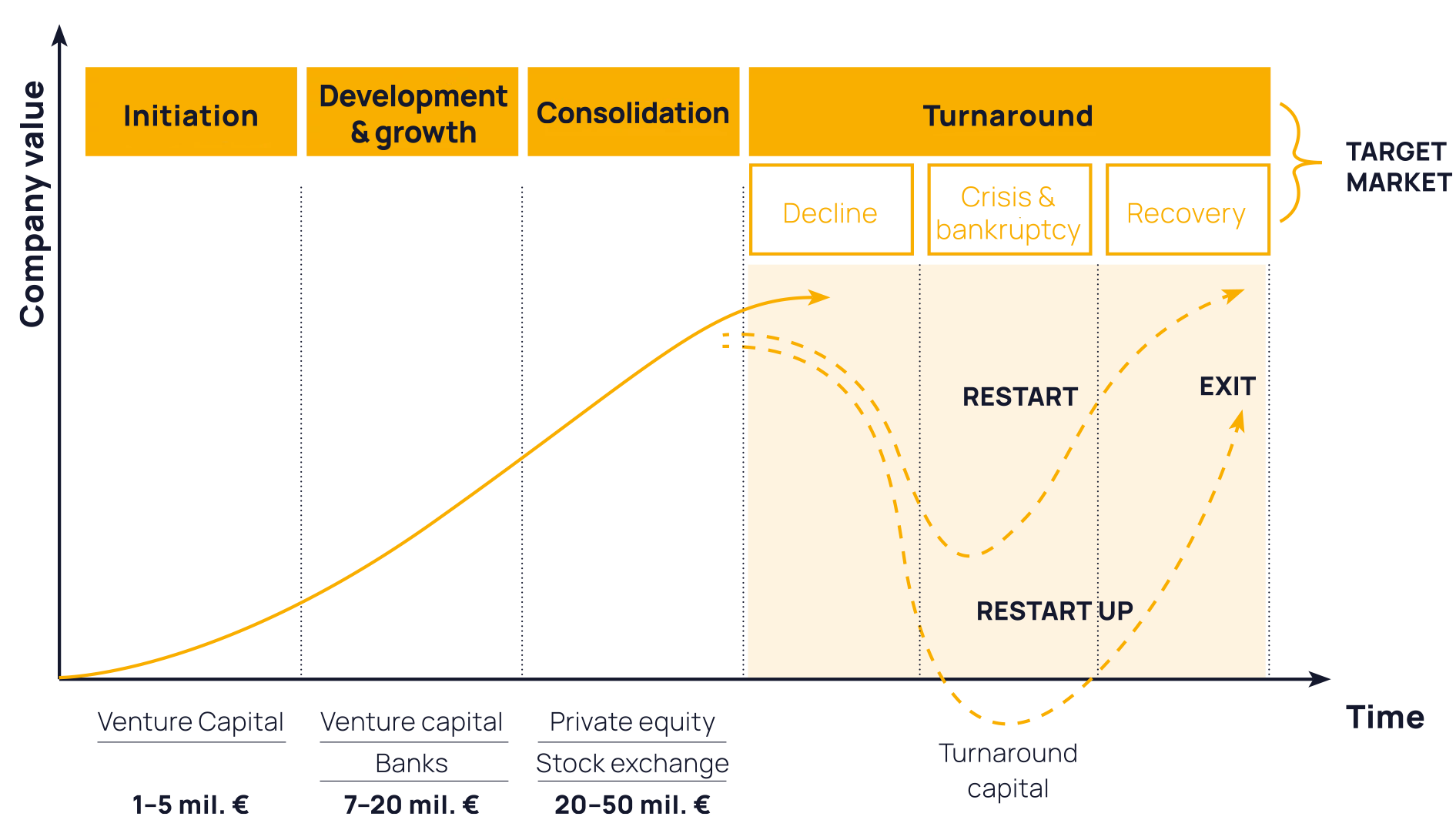

Our role involves deep analysis of company challenges, providing crisis management, devising fresh strategic plans, and securing the necessary funding for a company's revival.

Future-focused industries

Our private equity endeavors predominantly revolve around the mechanical engineering and food sectors, with products boasting international relevance and global distribution.

Custom-made investment strategies

Our investment approach is centered on transformative restructuring, often undertaken collaboratively with the initial stakeholders. Equity is meticulously crafted to suit each individual project's needs.

Turnaround

Tailoring success for every project

Through meticulous analysis, we craft strategies tailored to each project, whether it involves generational transition, preparing a company for sale, or turnaround management for a struggling business. This approach sets the stage for success and profitability to flourish.

Portfolio

Current subfund projects

Rojek

Rojek, a force in the world of boiler and woodworking machinery manufacturing, hit the notable milestone of 100 years in business in 2021, boasting a worldwide commercial presence.

Čerstvě nadojeno

Originating from the acquisition of an ecofarm, the company now produces organic dairy delights under the Bio Vavřinec brand. With CCFS’s backing, it’s set to broaden its distribution horizons.

Joxty SE

A producer of snacks made from Italian vegetables, Joxty chips are known for their natural flavor. Thanks to innovative production methods, they retain their natural colors and minerals.

Sumtex Europe

Sumtex Europe is a stable Czech textile company with a history spanning over 180 years. It produces custom-made cutting fabrics according to the specific requirements of its customers.

Key fund details

Legal form of the fund | joint stock company with variable share capital (SICAV) |

Fund type | qualified investor fund |

Background assets of the fund | equity investments and loans to subsidiaries |

Security issued | Investiční akcie třídy A1 Investiční akcie třídy C1 |

Public tradeability | ne |

Frequency of NAV calculation | monthly |

Minimum investment | 100 000 CZK (approx 4 100 EUR) + mandatory condition is minimal investment 1 milion CZK (approx 41 000 EUR) in all funds managed by Proton investiční společnost a.s. |

Cost rate of subfund in 2022 | 2.25% |

Entry fee | up to 3% |

Management fee | 2.3% |

Client's investment horizon | 6 years |

Frequency of investment share buyback | monthly |

Maturity of investment share buybacks | up to 4/9/12 months according to the % share of the investment shares bought back on the total capital of the fund and on the volume of shares of the respective investor |

Exit fee | 50% upon buyback within 5 years 3% upon buyback after 5 years |

Taxation of fund yields | 5% from the fund's profit |

Taxation of shareholders – natural persons | 15% upon buyback within 3 years, 0% upon buyback after 3 years |

Fund manager | Proton investiční společnost, a.s. |

Fund administrator | AVANT investiční společnost, a.s. |

Fund depository | CYRRUS, a.s. |

Fund auditor | AUDIT ONE s.r.o. |

INVESTMENT OPPORTUNITIES

Get in touch

We will be happy to provide you with a detailed overview of the investment portfolio, strategy, and fund hedging at a personal meeting or online.